Depreciation equation calculator

Calculate the depreciation rate ie 1useful life. Therefore according to the Australian tax law you can claim tax deductions on.

Depreciation Rate Formula Examples How To Calculate

Therefore for example at the end of 5 years annual depreciation is 90000 but the cumulative depreciation is 4500000.

. Total amount of depreciation of an asset cannot exceed its a Depreciable value b Scrap value c Market value d None of these. Get 247 customer support help when you place a homework help service order with us. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Vyapar depreciation calculator- Simplest online depreciation calculator for assetProperty etc using the SLM DBM methods. For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000.

D P - A. Follow the next steps to create a depreciation schedule. Enter the data values separated by commas line breaks or spaces.

Depreciation is an ongoing process until the end of the life of assets. The Car Depreciation Calculator uses the following formulae. Date Calendar Units Calculator.

You may also be interested in our LBM Calculator Lean Body Mass Calculator or Body Shape Calculator. It may be home appreciation investments or anything else you need but first you need to know how to calculate appreciation and what it isRemember that if the value of your product decreases over time you may use the depreciation calculator or use a negative appreciation. Depreciation is a decrease in the book value of fixed assets.

If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. Above is the best source of help for the tax code. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating.

How to use the calculator. Dividend 2000 Therefore the company paid out total dividends of 2000 to the current shareholders. Use this handy Probability Calculator to determine the probability of single and multiple events.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. C Decrease each year d None of them. The appreciation calculator is a tool that helps you find the future value of anything.

Year 1 depreciation 2 x 010 x 500000 100000 Now after writing off 100000 for the first year the book value of the taxi is. The APFT Calculator calculates your Army Physical Fitness Test score based on your gender age group number of sit-ups number of push-ups and your two-mile run time. Calculator-online is an authorized platform for those who need to make basic to advanced calculations online.

Whether you are thinking about replacing your old appliances like a washing machine or dealing with a home insurance policy that offers replacement cash value or actual cash value this calculator has got you covered. You can use this grouped frequency distribution calculator to identify the class interval or width and subsequently generate a grouped frequency table to represent the data. In that case you should use an investment property depreciation calculator to get at least a general idea about the tax deductions you can claim in your tax return.

Depreciation involves loss of value of assets due to the passage of time and obsolescence. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own. Use a Tax Depreciation Calculator.

Get 247 customer support help when you place a homework help service order with us. Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Suppose you need to calculate the depreciation of your property.

Each year the accumulated depreciation account will increase by 90000 per year. Following are the 3 principal features of depreciation. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on any outstanding penalties select the Due Date on which your taxes should have been paid this is typically the 15 th of April and lastly select the Payment Date the date on which you expect to pay the. Decimal Degrees to Degrees Minutes Seconds. Universal equation for estimating ideal body weight and body weight at any BMI.

Using it in the equation. The average car depreciation rate is 14. Water Intake Calculator new.

Decimal to Fraction Calculator. Depreciation Expense Depreciable Cost x Remaining useful life of the assetSum of Years Digits. We provided you with the 100 free online calculators.

Our main categories of free calculator online are health education finance informative. A P 1 - R100 n. Calculate Property Depreciation With Property Depreciation Calculator.

Let us take another example where the company with net earnings of 60000 during the year 20XX has decided to retain 48000 in the business while paying out the remaining to the shareholders in the form of dividends. MACRS Depreciation Calculator Help. According to straight line method of providing depreciation the depreciation a Remains constant b Increase each year.

Multiply the depreciation rate by the cost of the asset minus the salvage cost. Dividend Formula Example 2. Updated Study Notes and Revision Kits MASOMO MSINGI PUBLISHERS.

The Army Physical Fitness Test Calculator allows you to estimate your level of fitness according to the US. It remains in the companys accounts until the asset is sold. Debt to Equity Ratio Calculator.

Car Depreciation Calculator new. Note that the 275 and 39-year depreciation calculations are typically based on a mid-month convention. Currency Appreciation and Depreciation Calculator.

Our property depreciation calculator helps to calculate depreciation of residential rental or. This cumulative figure is the accumulated depreciation. Enter the details of the required number of intervals and click on the.

Cubic Equation Calculator - 3rd Order Polynomial. The following article will explain the. The depreciation equation for sum of years digits method is given below.

The American journal of clinical nutrition 1035 11971203. To use our calculator simply. Meaning in the first month you acquire the property you would get half mid-month of the first months depreciation not an entire month and the same holds true in the month you dispose of the asset.

The value we get after following the above straight-line method of depreciation steps is the depreciation expense which is deducted from the income statement every year until the assets useful life.

Annual Depreciation Of A New Car Find The Future Value Youtube

How To Calculate Depreciation

Depreciation Calculation

How To Calculate Depreciation Youtube

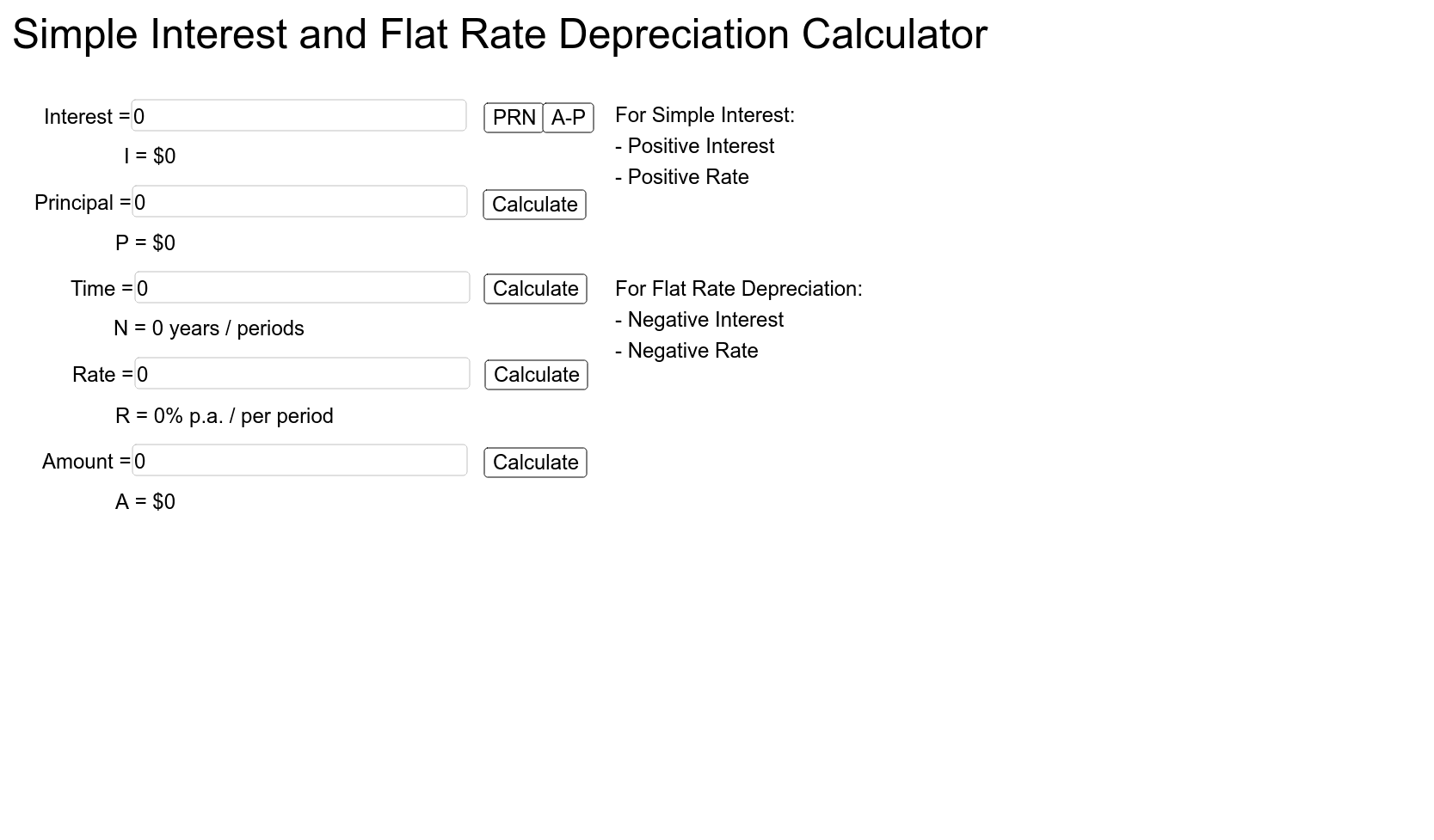

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Depreciation Formula Calculate Depreciation Expense

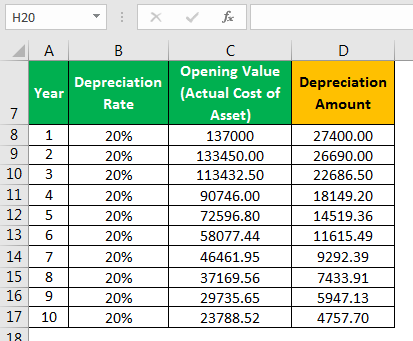

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator Double Entry Bookkeeping

Straight Line Depreciation Formula And Excel Calculator

Depreciation Expense Calculator Sale 59 Off Rikk Hi Is

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property

Free Macrs Depreciation Calculator For Excel

Accumulated Depreciation Definition Formula Calculation